The Medicare Annual Enrollment Period is here! The AEP runs from October 15th through December 7th and provides a chance for people covered by Medicare to change or add to their existing plan. For many people, the task of comparing insurance plans can seem overwhelming. We are here to walk you through the aspects of your current plan to consider, outline the benefits of comparing Medicare plans, and even provide step-by-step instructions on how to use our convenient shopping portal.

Assessing Your Current Coverage

Three of the main Medicare plan features to take into account are the cost, coverage, and additional resources or benefits offered by your current policy. Take a look at your medical expenses over the past year. Include payments you made towards your plan’s monthly premium, deductibles, and out of pocket expenses like copays or prescription drug costs. If you feel that you are paying too much for your coverage, you might be! You can schedule a no-cost assessment with us to help you identify a plan better suited for your budget and coverage needs.

The AEP is also a good time to check into how your healthcare and prescription drug needs have changed over the last year. A plan that was a perfect fit 12 months ago may no longer be right for your current situation. If you have started taking new medications, changed healthcare providers, or experienced another change in your health, the AEP provides a chance to bring your coverage and your needs back into alignment.

The AEP is also a good time to check into how your healthcare and prescription drug needs have changed over the last year. A plan that was a perfect fit 12 months ago may no longer be right for your current situation. If you have started taking new medications, changed healthcare providers, or experienced another change in your health, the AEP provides a chance to bring your coverage and your needs back into alignment.

Benefits of Comparing Medicare Plans

Every year, new carriers enter the Medicare market. These additions provide a wider variety of plans to choose from than the previous year. Premiums on Medicare Supplement Plans also go up year over year. You may find that the annual out of pocket cost for a Medicare Advantage Plan is less than your previous total yearly premium! Advantage plans are also likelier to include vision and dental benefits, as well as prescription drug coverage. These factors combined go to show that choosing your Medicare plan isn’t a one-time event for most people.

If you don’t look into the newer options available to you, you might miss out on your perfect plan. Comparison shopping your coverage is a win-win for anyone covered by Medicare. Deciding to switch plans can lead to more comprehensive coverage, better benefits, or more money in your pocket. Even if you check through your current plan and find that it’s still the right one for your needs, simply completing the research ensures that your budget and coverage are being well taken care of.

Steps to Compare Your Options

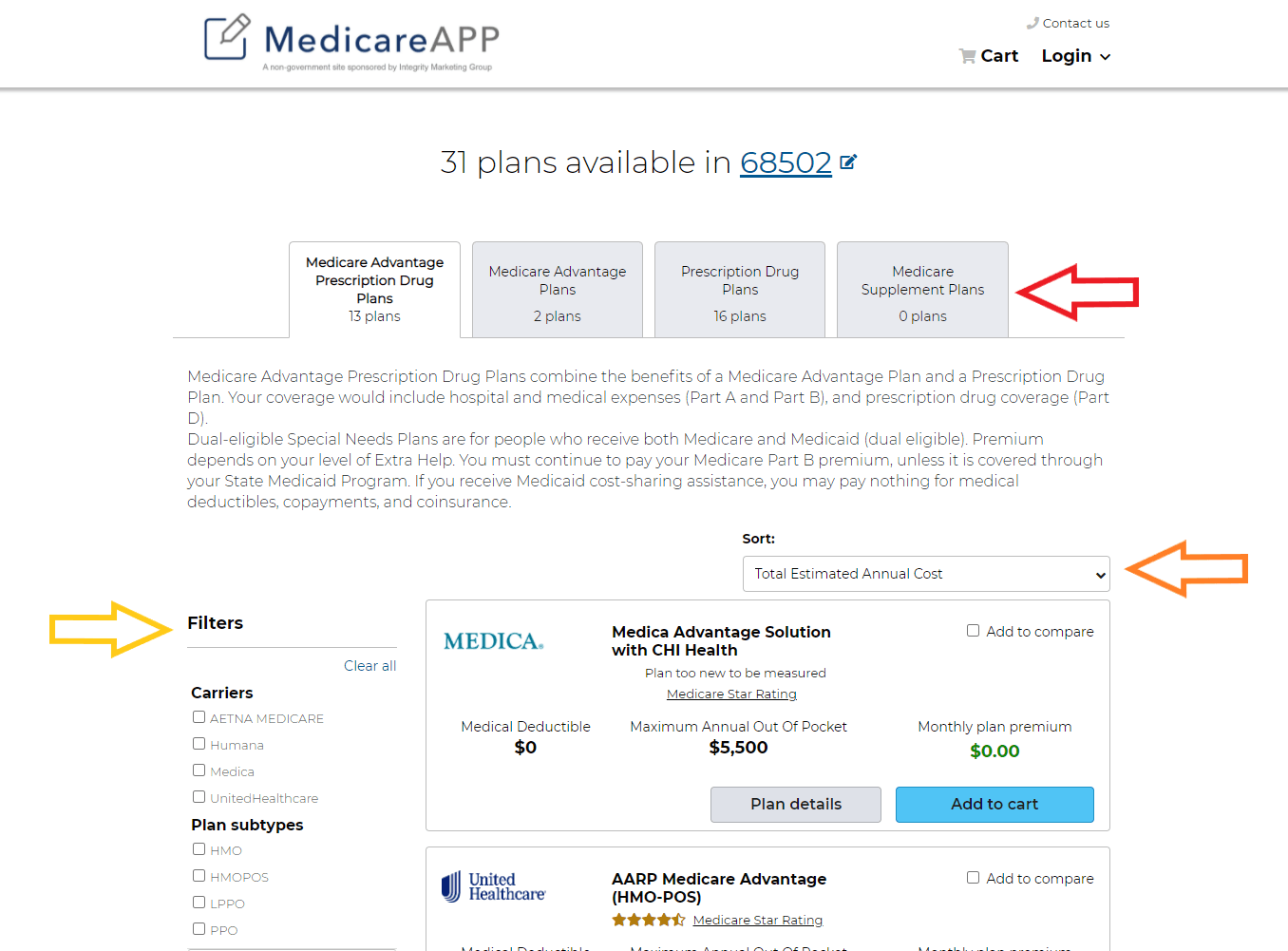

To start comparing the plans available to you, visit our shopping portal, enter your zip code, and click “View Plans” to see the options available in your area.

Once your list of options has populated, you can use the top tabs, dropdown menu, and filters to fine-tune the results that are displayed. You can organize the plans according to type, carrier, rating, and more!

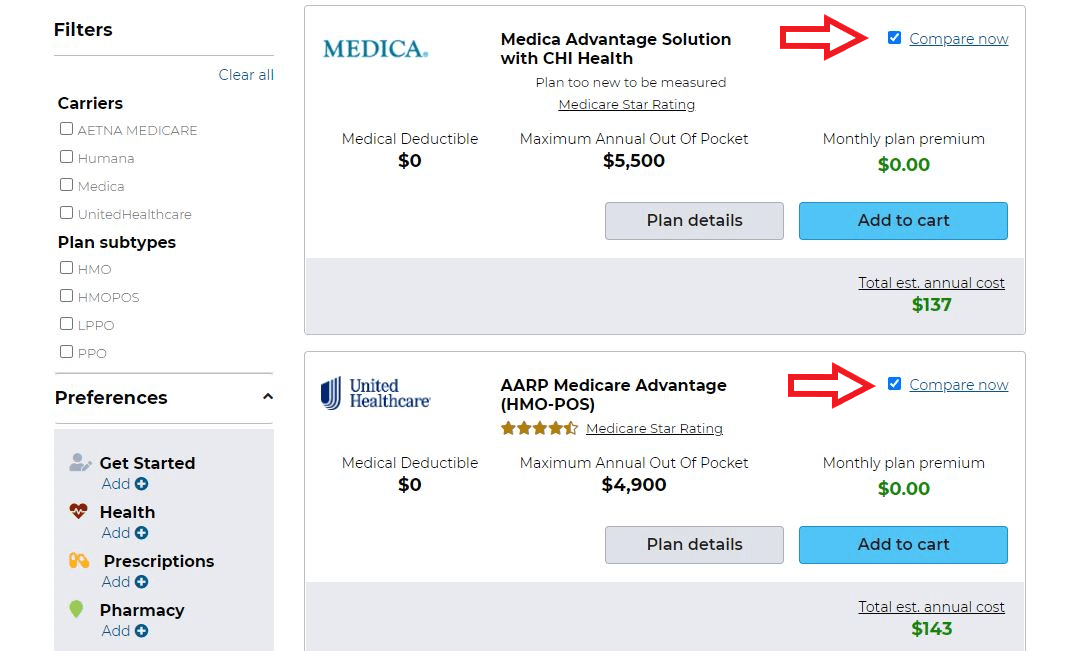

From there, you can select plans you would like to compare by clicking the “Add to compare” checkboxes. Clicking Compare now takes you to a new page with an apples-to-apples comparison of up to 3 different options.

Senior Insurance Advisors is here to simplify Medicare. Everyone enrolled in Medicare deserves the peace of mind that comes with knowing that their plan is the best fit available. You can rely on our knowledge and expertise to make the most of this year’s Annual Enrollment Period. Whether you use the shopping portal to compare plans or schedule a free one-on-one with Dana to talk through your options, we are here to help!