Medicare Products

Additional Coverage Options

OPTION 1

Add one or both of the following

to Original Medicare.

Medicare Supplement Insurance Plan

Offered by private companies

Medicare Part D Plan

Offered by private companies

Helps pay for prescription drugs

OPTION 2

Choose a

Medicare Advantage plan.

Medicare Advantage Plan

Offered by private companies

Combines Part A (hospital insurance) and Part B (medical insurance) in one plan

Usually includes prescription drug coverage

May offer additional benefits not provided by Original Medicare

OPTION 1

Add one or both of the following

to Original Medicare.

Medicare Supplement Insurance Plan

Offered by private companies

Medicare Part D Plan

Offered by private companies

Helps pay for prescription drugs

OPTION 2

Choose a

Medicare Advantage plan.

Medicare Advantage Plan

Offered by private companies

Combines Part A (hospital insurance) and Part B (medical insurance) in one plan

Usually includes prescription drug coverage

May offer additional benefits not provided by Original Medicare

Original Medicare

- Original Medicare includes Medicare Part A (hospital insurance) and Part B (medical insurance).

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

- If you choose Original Medicare, you can also decide to:

- Join a separate Medicare drug plan (Part D) if you want drug coverage.

- Add other insurance like Medicare Supplement Insurance (Medigap) to help pay for out-of-pocket costs like your 20% coinsurance.

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage.

Medicare Advantage (also known as Part C)

- Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D.

- Plans may have lower out-of-pocket costs than Original Medicare.

- In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs.

- Most plans offer extra benefits that Original Medicare doesn’t cover.

How do you choose between a Medicare Supplement and Medicare Advantage Plan? Below are a few considerations to keep in mind when reviewing your options.

Medicare Supplement or Medicare Advantage

Considerations

Medicare Supplement

Medicare Advantage

Coverage

- Pays some costs not paid by Original Medicare

- Does not help with drug costs

- Nationwide coverage

- Provides benefits of Original Medicare and beyond

- Often includes drug coverage

- May have provider network

Cost

- Monthly plan premium

- Drug plan premium and other costs if coverage added

- Out-of-pocket costs depend on plan chosen

- May charge plan premium

- Often no additional premium for drug coverage

- Copays or coinsurance for most covered services

- Annual out-of-pocket maximum

Convenience

- Multiple plans (when added to Original Medicare along with a Part D plan)

- All-in-one plan

Considerations

Medicare Supplement

Medicare Advantage

Coverage

- Pays some costs not paid by Original Medicare

- Does not help with drug costs

- Nationwide coverage

- Provides benefits of Original Medicare and beyond

- Often includes drug coverage

- May have provider network

Cost

- Monthly plan premium

- Drug plan premium and other costs if coverage added

- Out-of-pocket costs depend on plan chosen

- May charge plan premium

- Often no additional premium for drug coverage

- Copays or coinsurance for most covered services

- Annual out-of-pocket maximum

Convenience

- Multiple plans (when added to Original Medicare along with a Part D plan)

- All-in-one plan

Considerations

Medicare Supplement

Medicare Advantage

Coverage

- Pays some costs not paid by Original Medicare

- Does not help with drug costs

- Nationwide coverage

- Provides benefits of Original Medicare and beyond

- Often includes drug coverage

- May have provider network

Cost

- Monthly plan premium

- Drug plan premium and other costs if coverage added

- Out-of-pocket costs depend on plan chosen

- May charge plan premium

- Often no additional premium for drug coverage

- Copays or coinsurance for most covered services

- Annual out-of-pocket maximum

Convenience

- Multiple plans (when added to Original Medicare along with a Part D plan)

- All-in-one plan

We can help you identify which Medicare plan is right for you based on your needs and budget. Working with us can be very helpful so that you get all the statistics you need before you decide.

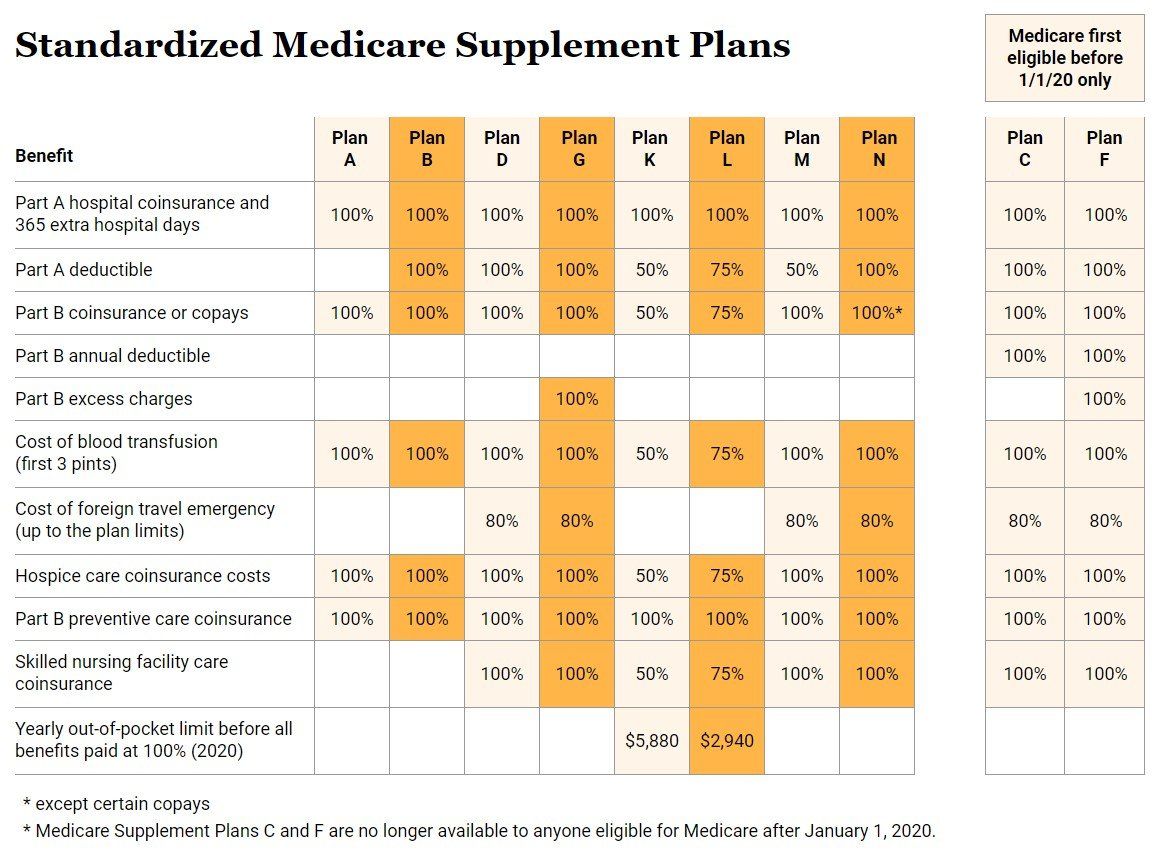

Medicare Supplement (Medigap)

Medicare Supplement plans are also known as Medigap insurance. Like Medicare Advantage plans, Medicare Supplement plans are sold by private insurers approved by Medicare. Medicare Supplement plans are not meant to replace Original Medicare, but act as supplemental insurance instead. Medicare Supplement plans reduce the out-of-pocket costs from Original Medicare (Part A and Part B), like copayments, deductibles, emergency travel costs, and coinsurance. If you purchase a Medicare Supplement plan after enrolling for Original Medicare, Original Medicare will cover your medical costs first, while your Medicare Supplement will cover the remaining out-of-pocket costs.

Eligibility and How to Enroll

You can become eligible for Medicare Supplement plans after enrolling for Original Medicare during your Initial Enrollment Period. The Initial Enrollment Period starts three months before your 65th birthday and lasts up to three months after turning 65.

Once your Part B coverage becomes effective, you have a guaranteed right to purchase a supplement plan. This marks the beginning of your Medicare Supplement Open Enrollment Period, which lasts for six months. This means insurers cannot reject your application based on your health. You may enroll in a plan later but could be denied or charged more based on health history. To find the right plan and to make the process simpler, you can contact us, and we can help you find the plan that matches your coverage needs.

Be advised a Medicare Supplement plan can't be used with Medicare Advantage plan.

What Does It Cover?

Every Medicare Supplement has to follow the guidelines created by Medicare itself when it standardized all plans. Each standardized plan is identified by a letter. There are ten Medicare Supplement Plans to choose from. Each one of these lettered policies provides the same set of benefits no matter what insurance company you choose. Each insurance sets their own rates for the plan or plans they offer.

Standardized Medicare Supplement Plans

Medicare first

eligible before

1/1/20 only

Standardized Medicare Supplement Plans

Medicare first

eligible before

1/1/20 only

Benefit

Plan

A

Plan

B

Plan

D

Plan

G

Plan

K

Plan

L

Plan

M

Plan

N

Plan

C

Plan

F

Benefit

Plan

A

Plan

B

Plan

D

Plan

G

Plan

K

Plan

L

Plan

M

Plan

N

Plan

C

Plan

F

Part A hospital coinsurance and

365 extra hospital days

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

Part A hospital coinsurance and

365 extra hospital days

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

Part A deductible

100%

100%

100%

50%

75%

50%

100%

100%

100%

Part A deductible

100%

100%

100%

50%

75%

50%

100%

100%

100%

Part B coinsurance or copays

100%

100%

100%

100%

50%

75%

100%

100%*

100%

100%

Part B coinsurance or copays

100%

100%

100%

100%

50%

75%

100%

100%*

100%

100%

Part B annual deductible

100%

100%

Part B annual deductible

100%

100%

Part B excess charges

100%

100%

Part B excess charges

100%

100%

Cost of blood transfusion

(first 3 pints)

100%

100%

100%

100%

50%

75%

100%

100%

100%

100%

Cost of blood transfusion

(first 3 pints)

100%

100%

100%

100%

50%

75%

100%

100%

100%

100%

Cost of foreign travel emergency

(up to the plan limits)

80%

80%

80%

80%

80%

80%

Cost of foreign travel emergency

(up to the plan limits)

80%

80%

80%

80%

80%

80%

Hospice care coinsurance costs

100%

100%

100%

100%

50%

75%

100%

100%

100%

100%

Hospice care coinsurance costs

100%

100%

100%

100%

50%

75%

100%

100%

100%

100%

Part B preventive care coinsurance

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

Part B preventive care coinsurance

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

Skilled nursing facility care coinsurance

100%

100%

50%

75%

100%

100%

100%

100%

Skilled nursing facility care coinsurance

100%

100%

50%

75%

100%

100%

100%

100%

Yearly out-of-pocket limit before all benefits paid at 100% (2020)

$5,880

$2,940

Yearly out-of-pocket limit before all benefits paid at 100% (2020)

$5,880

$2,940

* except certain copays

* Medicare Supplement Plans C and F are no longer available to anyone eligible for Medicare after January 1, 2020.

Cost

All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. Plans with more coverage will generally have higher premiums. Insurance companies have three ways of calculating the cost of Medicare Supplement plans:

- Issue-age-rated: Cost is based on enrollee's age when the plan is purchased. Younger enrollees will pay less of a premium than older enrollees, though the price may later increase due to inflation.

- Community-rated: The plan premium and associated costs are the same for all beneficiaries.

- Attained-age-rated: Cost increases with the enrollee's age; younger enrollees will pay less, though the price will increase as they get older.

If you have high out-of-pocket costs from Original Medicare, Medicare Supplement plans can serve as the way out. Call 402-673-6950 for more information and help with choosing a Medicare Supplement plan.

Medicare Advantage (Part C)

Medicare Advantage Plans combine Medicare Part A, Medicare Part B, and often Medicare Part D into one plan through private insurance companies approved by Medicare. Most Medicare Advantage Plans include drug coverage (Part D) and may offer additional benefits not provided by Original Medicare. In many cases, you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services to help protect you from unexpected costs. Some plans offer out-of-network coverage, but often at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. The most common types of Medicare Advantage Plans are:

Health Maintenance Organization (HMO) plans generally require that you get your care and services from providers in the plan's network. This means if you receive medical care from providers that are not in the network, you will most likely have to cover the out-of-pocket costs. HMO plans have a list of in-network healthcare providers that you can select from.

Preferred Provider Organization (PPO) plans have in network and out of network benefits, so you have the flexibility to see any doctor of your choice. In-network hospitals and providers are generally less expensive than out-of-network. You do not need to choose a primary care provider, and there is no need to get a referral for specialist visits.

Private Fee-For-Service (PFFS) plans give the freedom to visit any healthcare provider as long as they accept the Medicare Advantage service terms. This means you do not need to choose a primary care doctor, nor do you need referrals for specialist visits.

Special Needs Plans (SNPs) are tailored for individuals with certain health conditions who may need extra healthcare services. SNPs cover the same services as Medicare Part A and Part B, as well as additional services such as prescription drug coverage. The three types of SNPs include Dual-Eligible (D-SNP), Chronic Condition (C-SNP), and Institutional (I-SNP).

Cost

If you enroll for a Medicare Advantage plan, you must continue paying your Part B premiums. Apart from the Part B premium, Medicare Advantage plans may also have premiums, deductibles, coinsurance or copayments, or a maximum out-of-pocket limit, which can reduce the amount you will pay for medical services. You can’t be denied coverage at any time based on current financial or health status, including pre-existing conditions. Contact us today at 402-673-6950 for more information and help with choosing a Medicare Advantage plan.

Medicare Part D

Medicare Part D provides prescription drug coverage and is sold by private insurance companies. Most Medicare enrollees purchase prescription drug coverage as an addition to their Medicare coverage.

There are two ways to get coverage: add a standalone Part D plan to Original Medicare or choose a Medicare Advantage plan that includes prescription drug coverage. To become eligible for Part D, you must be enrolled in Medicare Part A, Medicare Part B, or both.

Cost

Your location, income, and the type of prescription drugs covered all affect the cost of a Part D plan. Due to changes in coverage options, the cost of a prescription drug plan may also change each year, so it’s very imperative you shop your prescription drug plan during the Medicare Annual Enrollment Period (AEP).

For most Part D plans, after spending $5,030, you will reach the coverage gap. In all plans, though, after spending $8,000, you will leave the coverage gap stage and enter into what is called the catastrophic stage. During this catastrophic phase, you won't pay anything for Medicare Part D covered drugs for the rest of the plan year. Depending upon what stage you are in, the amount paid for your prescriptions will vary.

Coverage

Medicare Part D covers the cost of selected prescription drugs. The coverage options may vary with different insurance providers. However, Medicare mandates Part D providers to provide coverage for certain prescription drugs. Each prescription drug plan has a list of prescription medications covered by the plan called the plan formulary. There is also a drug tier system that is used to categorize medications into groups. The lowest tier contains generic medications, while the highest drug tier contains specialty drugs. The higher the tier, the higher the cost. However, each Part D plan covers both generic and brand name medications.

Generally, Part D plan formularies must include coverage for immunosuppressants, antidepressants, anticonvulsants, antineoplastics (cancer treatment drugs), antipsychotics, and antiretrovirals (HIV/AIDS). You cannot get coverage for hair loss treatment medications, dietary supplements, cosmetic treatments, or weight control drugs through Medicare Part D. If you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin. You could pay as little as $35 for a 30-day supply.

Extra Help (Part D)

Extra Help is a program to help people with limited income and resources pay Medicare prescription drug program costs like premiums, deductibles, and coinsurance. Extra Help is estimated to be worth about $5,000 per year. To qualify for the Extra Help, a person must be receiving Medicare and have limited resources and income.

In 2024, you may qualify if you have up to $23,000 in yearly income ($31,000 for a married couple) and up to $17,200 in resources ($34,360 for a married couple). Not every asset you possess is included in your resource valuation:

Counted: Money in checking or savings accounts, retirement accounts, mutual funds, real estate, stocks, and bonds.

Not Counted: Your home, one car, your burial plot, or up to $1,500 worth of funds set aside specifically for burial expenses.

If you think you may qualify for Extra Help, please give us a call at 402-673-6950 and we will help you with the application process.

Hospital Indemnity

A hospital stay can be traumatic to your health, your wallet, and your family. Even if you have other medical insurance, there will almost certainly be costs that aren’t covered. That’s when a Hospital Indemnity insurance plan provides you with supplemental cash benefits you can use however you want. It provides peace of mind by offering customized protection that pays benefits in your time of need. Hospital Indemnity insurance pays you a cash benefit for each day you’re in the hospital.

This coverage is very flexible, you choose both:

- The number of days (6, 7, 8, 9, 10, 21, or 31)

- The cash benefit amount per day (from $100 to $600 in increments of $25)

It also pays cash benefits for:

- Travel to the hospital or medical facility and/or a hospital stay

- Inpatient mental health services

- Observation unit monitoring

- Emergency room services for injuries

Of course, there can be many other costs associated with hospitalization. Hospital Indemnity insurance also allows you to choose optional benefits at an additional cost, including:

- Ambulance or urgent care center services

- A cancer diagnosis

- Outpatient surgery

- Outpatient therapy and chiropractic

- Skilled nursing services

Whatever your need, a Hospital Indemnity plan can be customized to provide you with cash benefits and help protect your savings just when you need it the most.

Get A Free Quote

We will get back to you as soon as possible

Please try again later

All Rights Reserved | Senior Insurance Advisors | Privacy

All Rights Reserved | Senior Insurance Advisors | Privacy Policy

We are licensed and represent plans and carriers in AZ, CO, IA, KS, MN, MO, NE, SC, SD, TX, and WA. The following disclaimer is for Lancaster county in Nebraska, where we reside.

We do not offer every plan available in your area. Currently we represent 8 organizations which offer 53 products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program to get information on all your options.Not affiliated with or endorsed by the government or federal Medicare program. Participating sales agencies represent Medicare Advantage [HMO, PPO, PFFS, and PDP] organizations that are contracted with Medicare. Enrollment depends on the plan’s contract renewal. By providing the information above, I grant permission for a licensed insurance agent to contact me regarding my Medicare options including Medicare Supplement, Medicare Advantage, Prescription Drug plans.